This guide will show you to increases your purchase speed in an NFT drop by interacting directly with the smart contract rather than the website, and manually increasing your gas limit.

Step 1. Find a solid project where data shows the demand exceeds supply so you are likely to have a positive ROI.

For the purpose of this guide, I’ll use Hero Galaxy as an example. Data shows that this project is oversubscribed

Whitelist price was 0.069ETH however floor price on Opensea is 0.24ETH – that’s 3.5x the price.

Step 2. Load up your wallet with a sufficient amount of Ethereum for the purchase.

Pro Tip: Beating Others in Purchase Speed

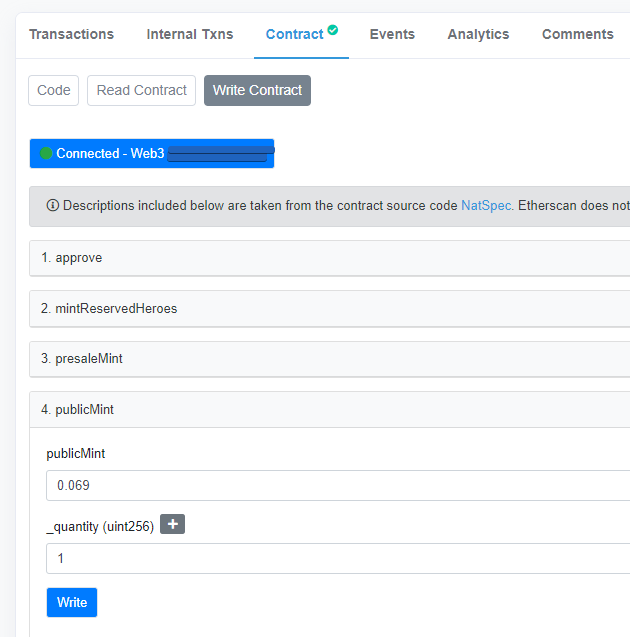

Rather than buying from the website, you can buy directly from the smart contract. If you want to maximize purchase speed, use this Contract Minting guide to navigate the etherscan contract.

Step 3.

30 seconds before the launch goes live on the website, try and mint directly on the smart contract.

This will allow you get to beat others on purchase speed, because sometimes the developers will open the smart contract BEFORE they open the website. Sometimes the website will also lag or crash, slowing down your purchase.

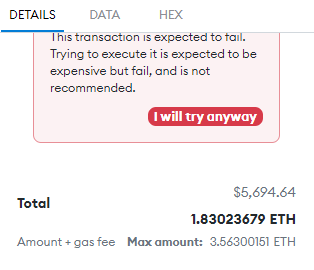

If you try and mint on the smart contract before the contract is ready, you will see an error like the below

What To Put In The Box

The above example is if I want to mint a quantity of 1 with a price of 0.069 each. The price of 0.069ETH each was provided by the website, so I know its the correct price.

Let’s say I want to mint the maximum quantity of 5.

5 * 0.069 = 0.345

IMPORTANT: Make sure you put the right price here. If you put the wrong price, you will OVERPAY for the NFT with no benefit.

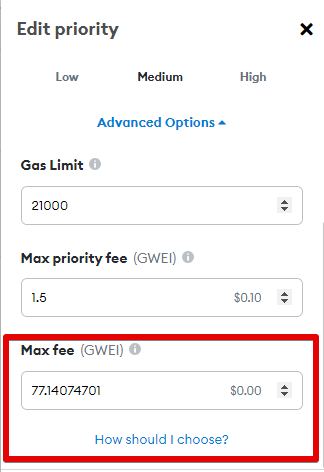

In order to process the transaction, you also have to pay gas fees.

0.345 + ((200000 * GAS_FEE) / 1000000000)

“Ripping gas”

The more gas you pay, the higher you get placed on the queue. So people will often “rip gas” like crazy in order to speed to the front of the line. So let’s assume you are willing to pay more gas, 1500 gwei worth

You can use the equation:

MINT_VALUE + ((GAS_LIMIT * GAS_FEE) / 1000000000) = TOTAL COST

For this project, we predict the gas limit based on what we see other people put for their gas limit

.345 + ((200000 * 1500) / 1000000000) = 0.645ETH

In other words, 0.345ETH for the 5 NFTs, and 0.3ETH for the gas rip.

WARNING: Gas fees work like a lineup, and run the risk of you losing your funds. Imagine there are 1000 NFTs for sale, but 2000 people want to purchase them. Assuming everyone submits their transaction at the same time, 1000 people submit 100 as gas limit, 1000 people submit 50 as gas limit. The bottom 1000 people will not get their NFTs, but will still have to pay the gas fee. This is known as a “failed transaction”. Of course, you still get your ETH for the purchase price returned. However its almost like you wasted $50-$100 on gas for nothing.

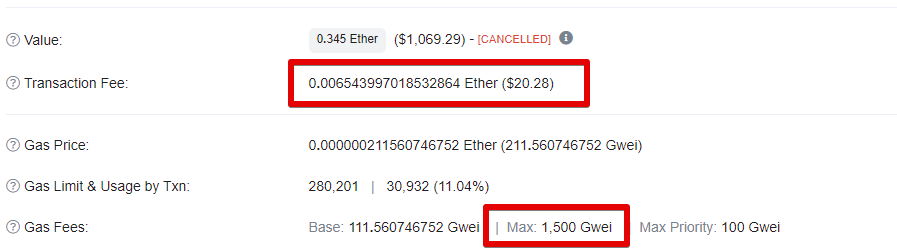

Example Failed Transaction

For example, I set 1500 gwei on this transaction and my transaction failed because everyone submitted 5000. My wasted money was $20.

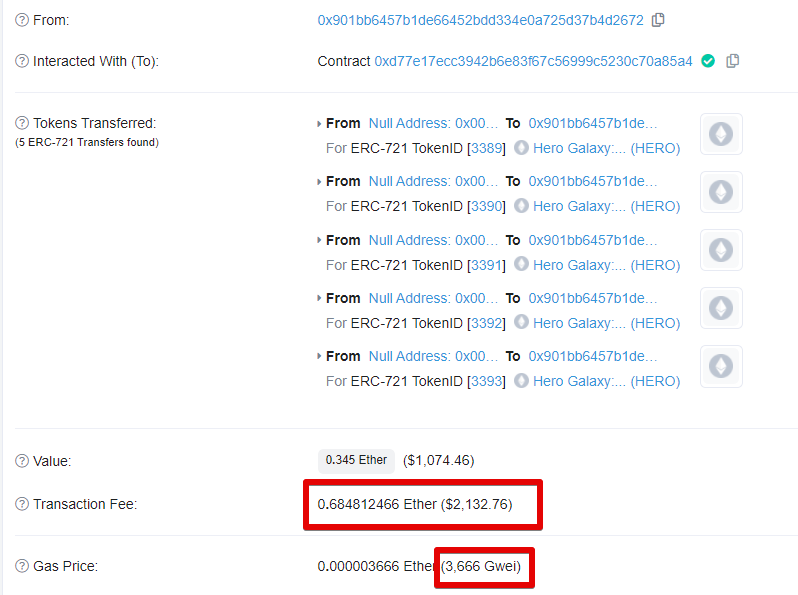

Below is an example of a successful transaction at 3666 Gwei.

https://etherscan.io/tx/0x831cb15a46839bf34a3de947662569484bae61d3f383643fb6c503f98257b1af

Calculating Total Profit

You might think, that’s a crap ton of gas fees, but you have to consider two things

1) It’s more cost efficient to rip gas when you’re minting 5 then 1, since its a single transaction fee.

2) You have to look at it from an overall cost and ROI perspective. 0.645ETH for 5 NFTs is an average cost of 0.129ETH per NFT.

This project has a 9.5% royalty fee on each sale.

Open sea charges a flat 2.5% fee on each sale.

At the time of this post, 1 ETH = approx $2900USD

Cost: 0.129ETH * 5 = 0.645ETH ($1850USD)

Sale price: 0.30ETH * 5 = 1.5ETH = ($4600USD)

Fees: 12% = 0.18ETH

Overall profit: 1.5ETH – 0.645ETH – 0.18ETH = 0.675ETH = ($2000USD)

Launch Behavior

There can be a few scenarios at launch

1) Everyone who couldn’t buy the public launch will fomo buy into floor price which causes it to moon

2) Everyone who buys public launch immediately sells which causes it to drop.

At the end of the day, as much as the forecasting above helps, you have to be reactive trader – you have to watch for market signals and change your strategy accordingly.

Have fun!

Appendix – Gas Fees Breakeven

If you want to get really technical on the gas fees, you can model out different gas levels and the according costs to calculate your ROI.