First published: Feb 15, 2022 – Tweet

In this investment thesis I will share a fundamental analysis and technical analysis of high risk, high reward project that I strongly believe will result in a 100%-1000% ROI in the next year.

Fundamental Analysis

I came across this project because I am bullish on the overall Near Ecosystem. Near is a top 10 smart contract platform; not as big as Solana, but bigger than Fantom or Tezos. I am subscribed to Taiki Maeda‘s premium Discord in which he presents a macro thesis that competitors to Ethereum like Avalanche and Solana had the most explosive growth in 2021, and so farming on an up and coming blockchain presents great upside for 2022. He specifically recommends farming on Trisolaris (It’s like SushiSwap but for the NEAR Blockchain). I noticed this project has the highest APR on the Trisolaris DEX, and so did further research to find if it has any fundamentals or was a random useless fork.

When I came across the funding announcement from Coinbase Ventures, it began to grow my belief that this is likely a solid project. Secondly, when I saw that Figment Capital also invested in the company, I knew that I had an informational advantage because I interviewed at Figment for a job and understood their strategy. Lastly, I personally know someone working at hack.vc who also invested in their company. I never had a conversation with them but that’s enough to know this is not made up.

Figment is a blockchain infrastructure service provider that competes directly against Alchemy and Infura. In order to write to a blockchain like Ethereum, you have to run a validator node, which is complicated business. That’s why companies like Axie Infinity rely on Alchemy to run their blockchain infrastructure for them, so their developers can focus on coding. Think of it like Amazon Web Services, but for blockchain. Where Figment takes a different approach to its competitors is that it tries to use only open source tools in its platform. The industry equivalent is Microsoft Azure (all private) vs. Red Hat Enterprise Linux (all open source). So for example, they partnered with Graph Protocol (GRT Token, top #54 market cap) for their blockchain querying service. Graph Protocol gave them a large investment of tokens from their ecosystem fund as an incentive to embed their service into their platform. In return, Software Engineers at Figment have to spend time integrating their protocol to make sure its successful. These aspects are what I have first-hand research on, however for Flux I don’t have first hand research on as I haven’t talked to anyone there. They held an AMA in February which was open to anyone but I missed it.

Flux Protocol is a blockchain infrastructure service relating to price feeds. Whitepaper here. It is in the similar category to Chainlink which is a price oracle for blockchains. Oracles allow applications to ingest off-chain data, like the result of a sports game or the inflation rate. I have a general bias towards investing in blockchain infrastructure projects because if you look at the Top 100 Market Cap projects, the majority are infrastructure, not applications. Think of it like everybody wants to build the next big video game, but the industry is so nascent we need people building the next Unreal Engine. You build infrastructure, then platforms on top, then applications.

Therefore my overall investment hypothesis on this is not scientific in nature but more of a combination of inferences from first hand research from working in the industry, and market research done from public information online.

When information around best practices are scarce, you can try the inversion; try avoiding worst practices. In the case of crypto investing, worst practices are:

– Investing in scams or rugpulls (often anonymous teams)

– Investing in projects that rely on ponzinomics to have price stability (OHM or TIME are examples)

– Investing in projects likely to go bankrupt (no revenue model or no funding)

– Investing in projects that are too early for the market e.g. the probability of a VR blockchain play succeeding in the next 5 years are super low

This project exhibits none of the “red flags” above, while also presenting a huge incentive to participate (super high APR).

It’s also worth noting, the company received $10m in seed funding but the total market cap of the tokens is only $7mil. I would consider this a sign of being undervalued.

There are two options to liquidity mine this position.

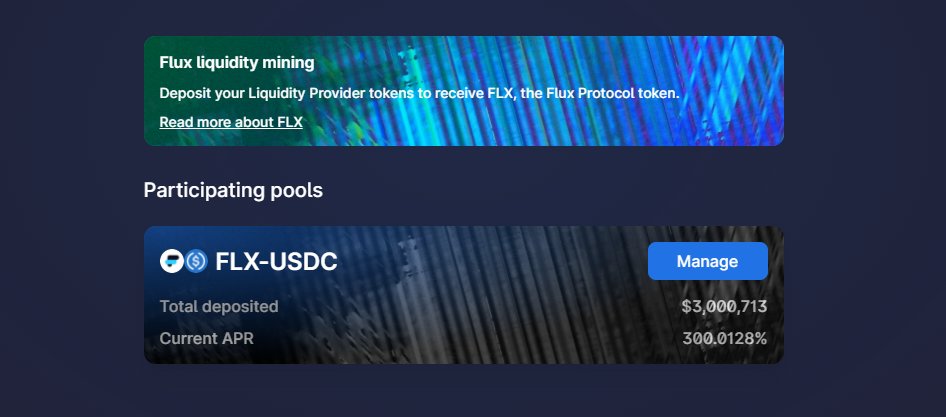

– FLX-USDC on Uniswap – 300% APR, with around $250 of ETH gas fees to open the position

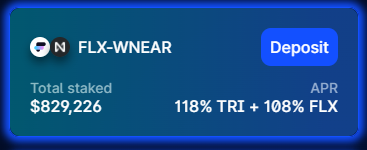

– FLX-WNEAR on Trisolaris. – 100% – 200% APR, fluctuates a lot – minimal fees.

The reason for the price difference is that the team decided to allocate a higher portion of staking rewards to Uniswap as its the most popular DEX.

Technical Analysis

Quick Facts

Tokenomics

As it is described in the whitepaper, the rewards should run for 4 years.

Potential Returns

The first thing to note, is the the APR is currently super high at 300%. If you compound monthly it is 1350% APY (Calculator). Another way to look at it is that 300% APR is 0.8% daily. So $10k in this pool gets you $80/day in FLX or a payback period of 125 days.

That is assuming all variables stay constant, which is very unlikely. The APR is influenced by a few things:

– The token emission schedule. In this case, we’ll assume its fixed for 4 years.

– The number of stakers. The more people that stake, the more the rewards are split.

– The price of the token. Assuming the above variables stay constant, if the token price doubles your APR doubles. If token price reduces in half, your APR gets cut in half.

Let’s use some examples to illustrate:

The Total Deposits is $3mil, and your deposit is $30k, so your percentage of the pool is 1%.

The token emissions are 33333FLX per day. 1% of that is 333FLX/day.

The price of FLX is $0.54.

Scenario 1 – Price of token stays flat

Your annual return on $30,000 is 333FLX * $0.54 * 365 days = $65437

APR = $65437 / $30,000 * 100 = 218%

Scenario 2 – You stake, then price of token rises 100%

Your annual return on a $30,000 is 333FLX * $1.08 * 365 days = $131268

APR = $131268/$30,000 * 100 = 437%

Scenario 3 – You stake, then price of token drops -50%

Your annual return on $30,000 is 333FLX * $0.27 * 365 days = $32817

APR = $32817/$30,000 * 100 = 109%

Scenario 4 – You stake, then price of token drops -90% (Worst Case)

Your annual return on $30,000 is 333FLX * $0.054 * 365 days = $6563

APR = $6563/$30,000 * 100 = 21%

Principal of $15k USDC / $15K FLX would suffer from -42.% impermanent loss and now be worth $9750.

ROI = ($9750 + $6563) / $30,000 = -54%

Reasons for Entry

– Small cap ($7mil) provides room for large upside multiples – it’s easier for a $7mil coin to go 5x than a $100mil coin to go 5x.

– Price is at an all time low. I see this as being “the bottom”. Price level is below ICO price ($0.58) vs. $0.80

– Token has a max supply i.e. is not a super inflationary DeFi token

Comparable Projects (source)

ChainLink (LINK) (6billion market cap): A decentralized oracle network that provides reliable real-world data for smart contracts across countless blockchains and applications in the cryptocurrency world.

Band Protocol (BAND) (150million market cap): A cross-chain data oracle platform that aggregates and connects real-world information to smart contracts. With Band Protocol, users can build on-chain networks of decentralized apps (Dapps), token issuance systems, and reputation scores for digital assets.

Kylin (KYL) (17million market cap): A cross-chain platform that aims to power the data economy on Polkadot. It will be the infrastructure for decentralized finance (DeFi) and web 3.0, powered by the Polkadot/Substrate framework.

Catalysts:

- Roadmap available here

Risks

- The protocol votes to significantly decrease the APR – happened – March 9 update

- Protocol does not deliver their product

- Impermanent loss risk – if the price delta between both tokens diverge by more than 300%, than a IL loss of of 14% will occur. Any less than 300%, IL is generally offset by liquidity rewards. Calculator here

- Beefy.finance gets hacked and funds get drained

Trade Plan

- If FLX increases in value by 3x, its a sell

- The Uniswap Staking rewards run from Dec 9 2021 to Dec 9 2022. Selling 30 days prior would be suggested

Links to Resources

The best link for information on their project is their medium page

The Founder’s LinkedIn and Twitter are publicly available, as well as the Team’s LinkedIn.

On January 9th, announced their liquidity mining incentive for Trisolaris; 125,000 FLX distributed monthly on Trisolaris until Dec 2022. Trisolaris similarly announced, their TRI rewards will only last for 3 months.

The below screenshots are for educational purposes only and are not my investments.

Example Uniswap Position

Example Trisolaris position