Before your conversation, look up a few things.

1. What’s the valuation of the company?

2. What is the estimated market value of the equity offered?

3. How much company ownership does this represent? i.e. – how many outstanding shares are there?

4. What is the strike price? (What is the discount vs. the preferred price that investors pay?)

5. What does the equity refresher schedule look like, if any?

6. When do I have to exercise my options? Is there a PTE window?

7. Is there any acceleration of my vesting if the company is acquired? (This is called a single trigger. A double trigger allows you to fully vest if the company is acquired AND you get laid off. Not too uncommon after acquisitions)

8. Has your company ever participated in a tender offer to allow employees to cash out pre-IPO?

Other Resources

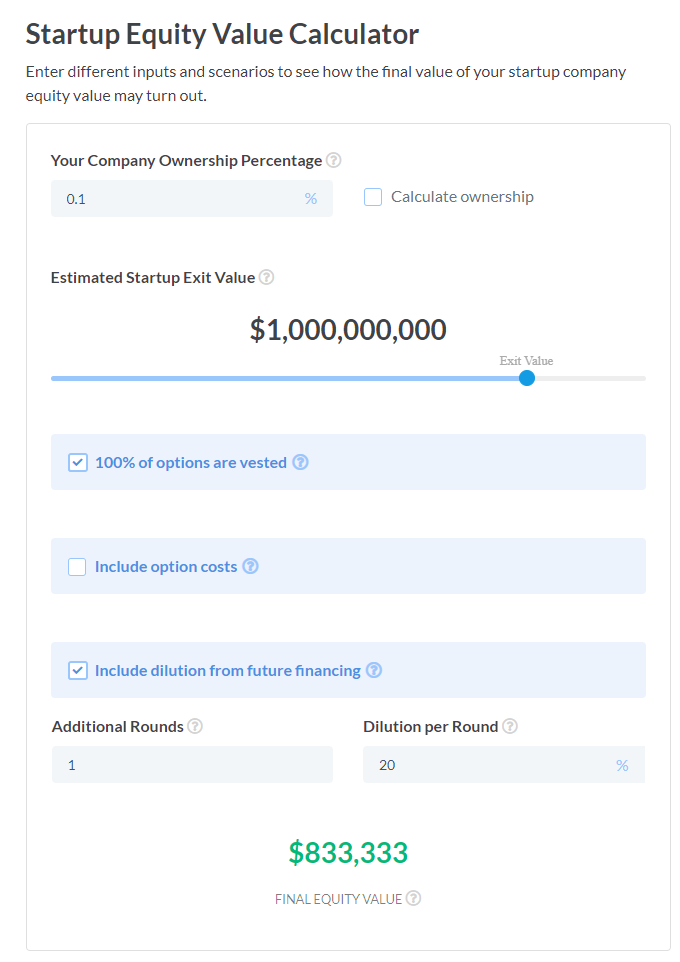

Remember that 10 basis points (0.1%) of a $1bil unicorn company is worth about $800k after tax

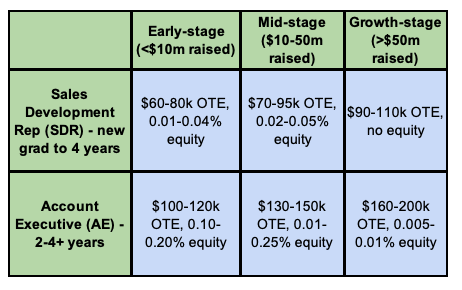

Here is a list of equity levels you can expect according to Holloway’s Guide:

There are no hard and fast rules, but for post-series A startups in Silicon Valley, the table below, based on the one by Babak Nivi, gives ballpark equity levels that many think are reasonable. These would usually be for restricted stock or stock options with a standard 4-year vesting schedule. They apply if each of these roles were filled just after an A round and the new hires are also being paid a salary (so are not founders or employees hired before the A round). The upper ranges would be for highly desired candidates with strong track records.

- Chief executive officer (CEO): 5–10%

- Chief operating officer (COO): 2–5%

- Vice president (VP): 1–2%

- Independent board member: 1%

- Director: 0.4–1.25%

- Lead engineer 0.5–1%

- Senior engineer: 0.33–0.66%

- Manager or junior engineer: 0.2–0.33%

https://medium.com/swlh/understanding-startup-stock-options-4bf9cc26089e

https://www.holloway.com/g/equity-compensation – 80 page guide