Published: Jan 8th, 2022

In this post, I will analyze 5 whale wallets to uncover what invest strategies some of the biggest hodlers use.

Check out these 5 whale wallets with over $50million in crypto each: https://zapper.fi/account/0x1c0b104a9eeff2f7001348a49fa28b8a0d23d637… – $106M https://zapper.fi/account/0xe97178f627268f4cead069237db9f50f66d17d97… – $19M https://zapper.fi/account/0x23a5efe19aa966388e132077d733672cf5798c03… – $44M https://zapper.fi/account/0x9a67f1940164d0318612b497e8e6038f902a00a4… – $100M https://zapper.fi/account/69secrets.eth/ethereum… – $230M

Wallet 1 – $106M portfolio with mainly stablecoin yield farm.

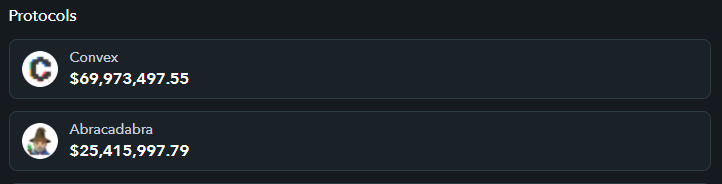

This person is mainly farming stablecoins, and is using the SPELL protocol to leverage their current assets. 70% is in Convex, 25% in Abracadabra, 5% in other.

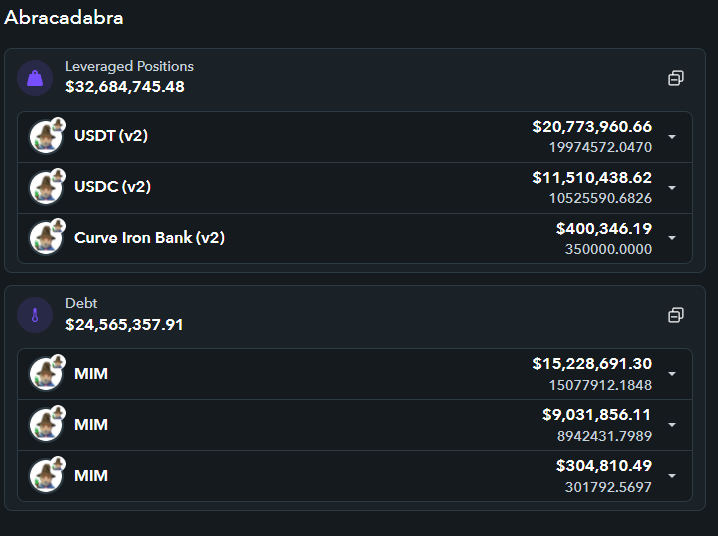

They deposited $32mil worth of USDT, then used that as collateral to withdraw $24mil worth of MIM, which is a 0.75 debt to collateral ratio.

They then took that MIM along with some additional MIM to form a $65million position on Curve.fi across to yield farm stablecoins. Curve basically treats stablecoins as fungible assets, since they are all worth $1, so you can form a LP position with 50% MIM 13.33% DAI, 13.33% USDC, 13.33% USDT, as you can see below.

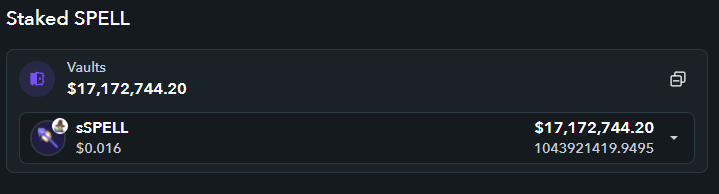

Lastly they are staking $17million worth of SPELL. That’s a pretty huge position for one coin. I guess they are a big fan of the protocol. The fees generated from the trades plus liquidations are listed in the dashboard

Therefore, wallet 1 is basically a farming the heck out of stablecoin yield farms and is leveraging to do so. Basically its a $100million portfolio with an APR probably around 5%, so generating $5mil/year.

Wallet 2 – $19M Portfolio

This person has a heavy position in SPELL, and the rest of their money in a stablecoin yield farm.

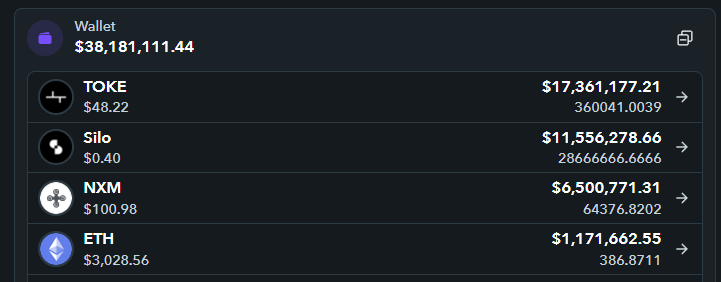

Wallet 3 – $42M portfolio, major holder of TOKE and SILO

This person is a basically a whale across two coins. I wouldn’t call them very diversified.

TOKE is a rank #178 market cap DeFi protocol.

SILO is a rank #677 market cap DeFi protocol as well. The market cap is $40mil, so its like he holds 25% of the total token supply. Maybe this wallet is the founders wallet or something because that’s majority shareholder level.

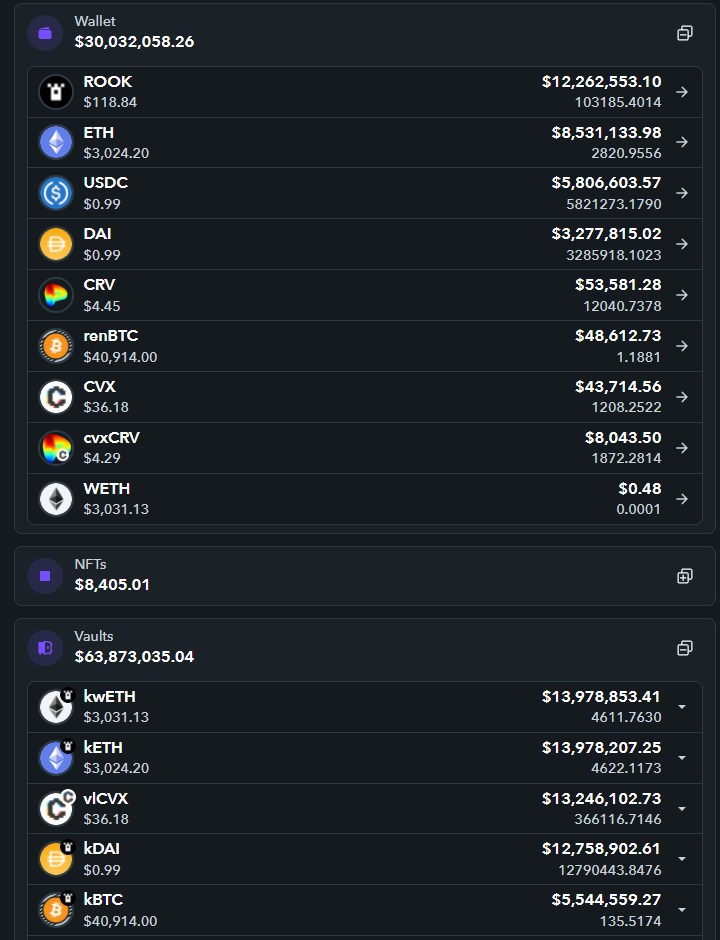

Wallet 4 – $97M $ROOK Maximalist

This person is either a ROOK maximalist or staff member. They have 80% of their portfolio in that protocol. KeeperDAO is a DEX that protects from market manipulation like front running through their proprietary algorithm.

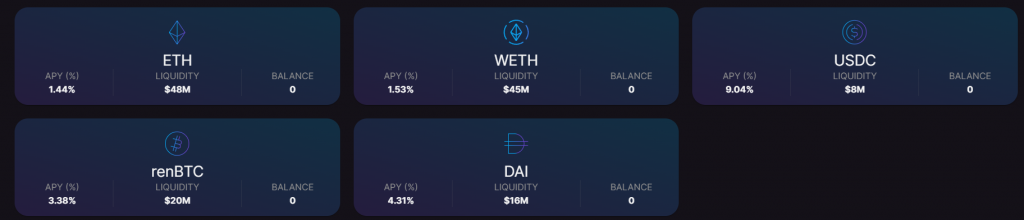

From what I see, he’s earning between 1-2% interest on their bitcoin and ETH positions, which seems pretty low. They are actually the majority LP provider. So it makes me think this wallet likely belongs to a staff member of the project.

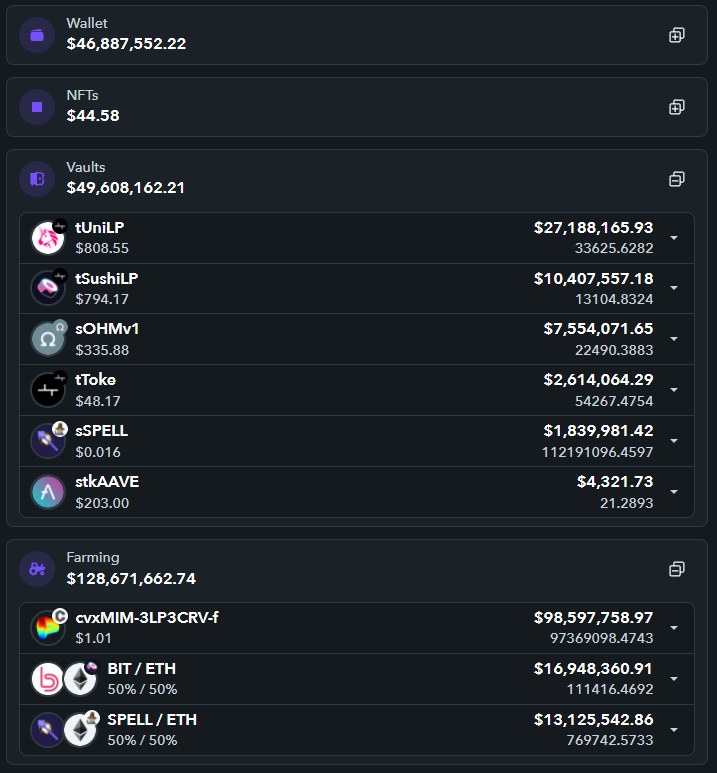

Wallet 5 – $230M portfolio with mainly stablecoin yield farm.

This person has $46mil just sitting in their wallet in ETH and USDC cash equivalent. Not sture why.

Their major position is a stablecoin yield farm of $98M, while also holding major liquidity mining positions in TOKE/ETH, TOKE/SUSHI, BIT/ETH, SPELL/ETH.

Conclusion

In conclusion, the most common strategy across these 5 wallets is stablecoin yield farming on Curve. Understandably, it is probably the lowest risk strategy available in crypto. To further improve this blogpost in the future, it would be interesting to explore to other whale wallets. These were just random ones I found on Twitter.