Published: Nov 6, 2021

The reason I share the following is not to give investment advice, but to get feedback on my hypothesis.

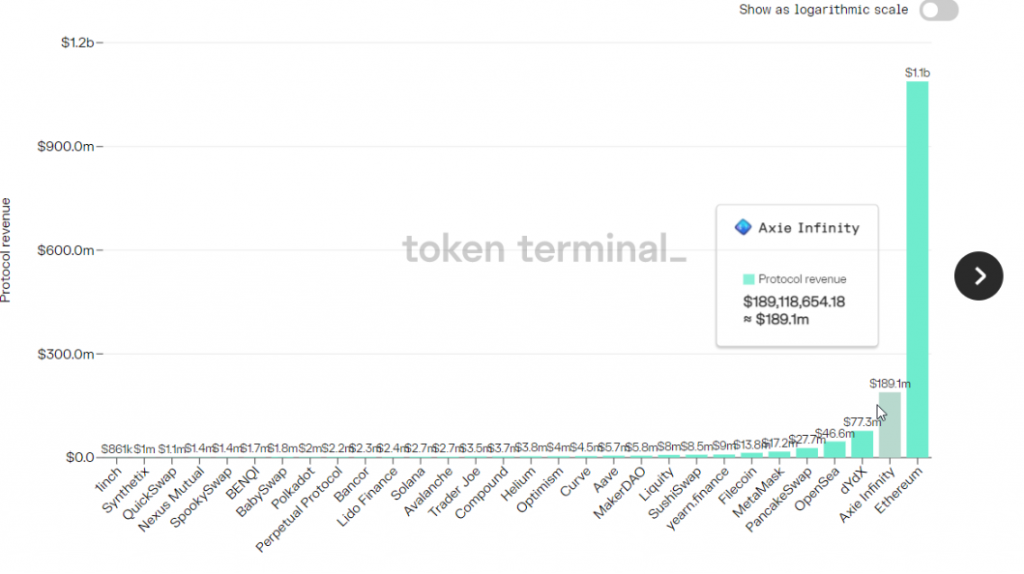

I am super bullish on AXS as an investment opportunity because it ranks #1 in revenue of all decentralized applications AND it has the highest staking reward APR % among any coin >$1bil market cap.

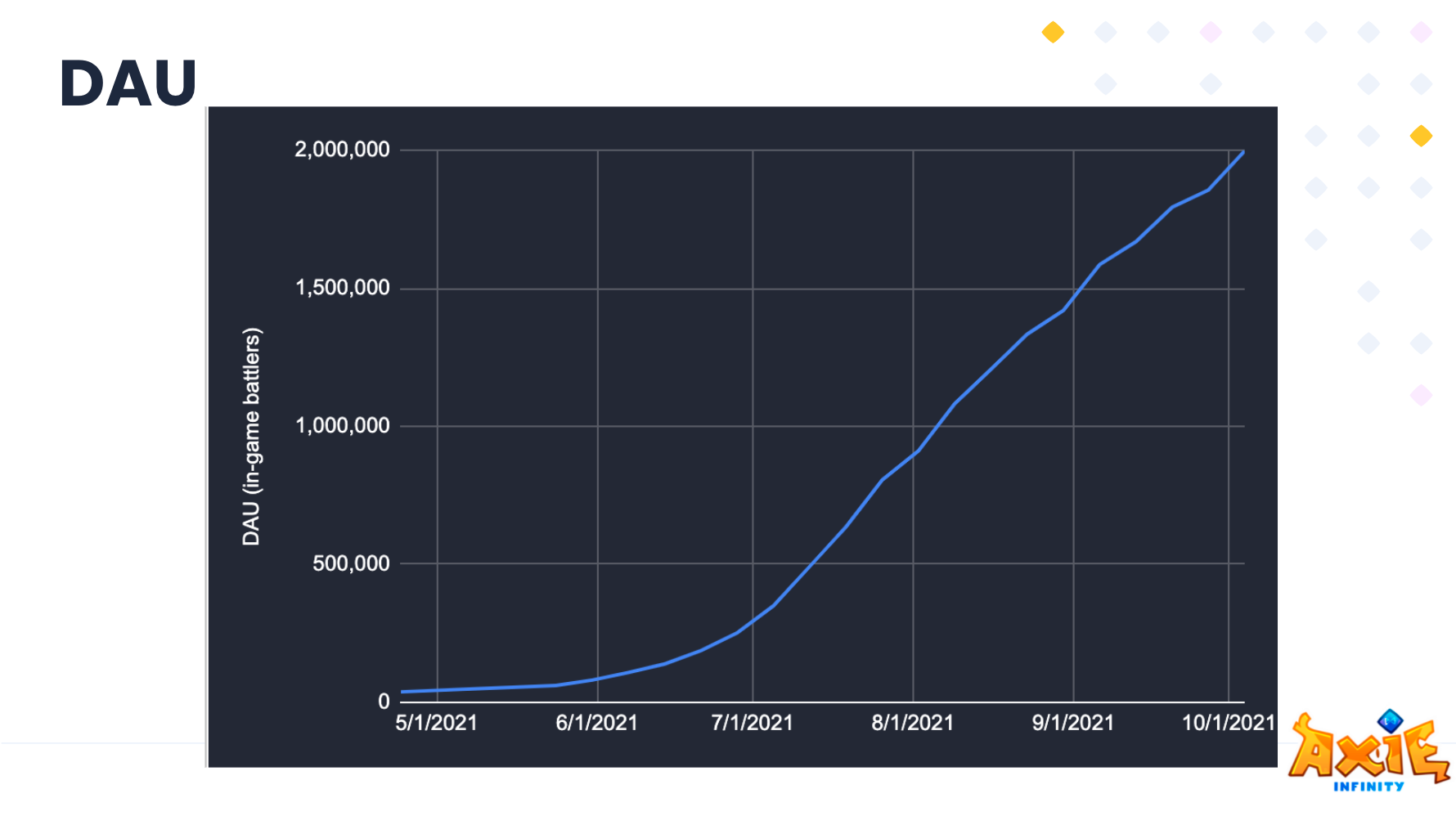

Let’s look at some numbers from a business perspective – the DAU and MRR.

2 million daily active users, and $180million in monthly recurring revenue

For comparison, Clash of Clans as the #1 mobile game has 2 million DAU, and Candy Crush has 1.5 million DAU.

Blockchain Platforms Are Different Than Decentralized Applications

To clarify, Ethereum, Solana, Cardano, Avalanche are blockchain platforms. The following are decentralized applications: Axie Infinity (biggest crypto game), OpenSea (biggest NFT marketplace), Metamask (most popular non-custodial wallet). Axie Infinity ranks #1 in protocol revenue among all decentralized applications, and it’s built on the Ethereum platform.

AXS generates revenue by charging 4.5% per transaction on their platform. Think of it like Pokemon cards, where you need to buy cards to play, and you are constantly trading cards to make a better deck. They currently have a monopoly on the marketplace and charge fees accordingly.

The Mechanics Of Actually Acquiring The Investment

Before discussing ROI, I want to explain the mechanics of acquiring the asset because the complexity of the process and trustworthiness of exchanges is a big turn off to most amateur investors.

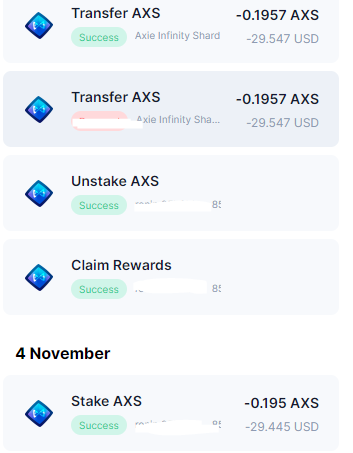

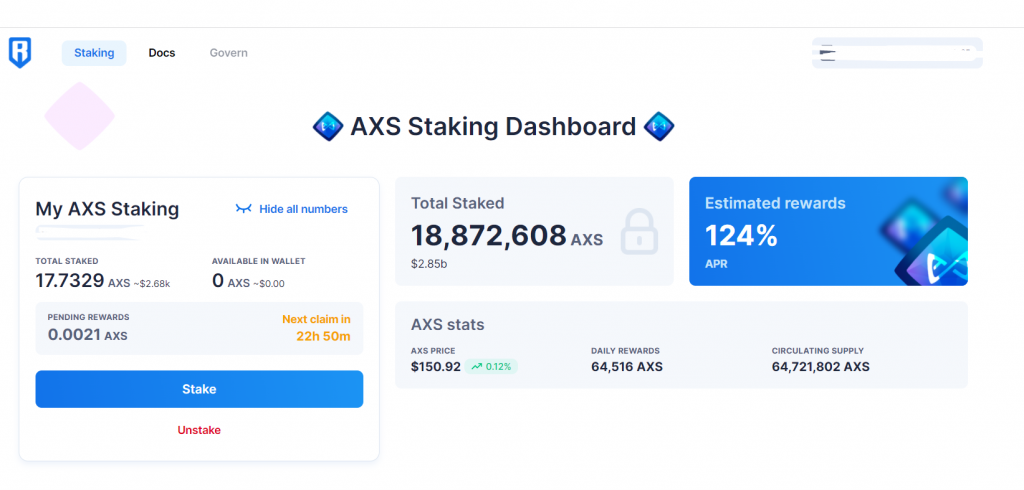

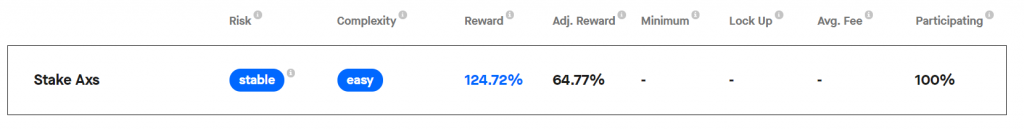

I was able to buy AXS off Binance, stake it on the Ronin wallet, and test that the staking gave me the promised amount after 1 day (0.3% in daily interest which is 124% annually).

I started by staking a small amount of AXS, ($29 USD). After 1 day, I received 0.007AXS in interest. It worked, no hiccups or hidden fees.

To make sure I could get my money out, I tried unstaking it, removing my funds from the AXS wallet and then withdrawing into Binance without any issues. The transaction fees were less than a dollar each time.

I then put in a couple thousand more dollars as you can see below.

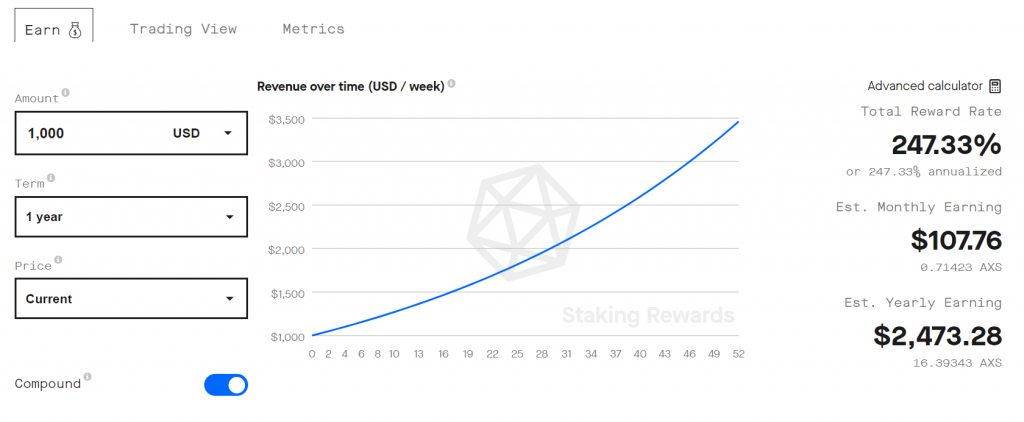

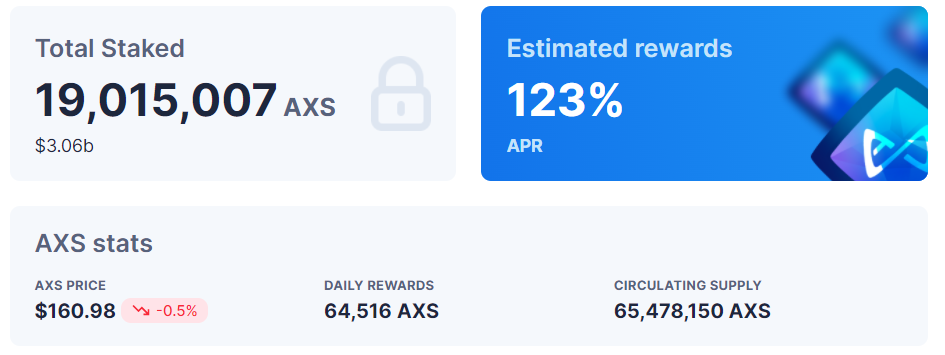

Above, you can see the staking rewards rate (aka APR) is currently 124%.

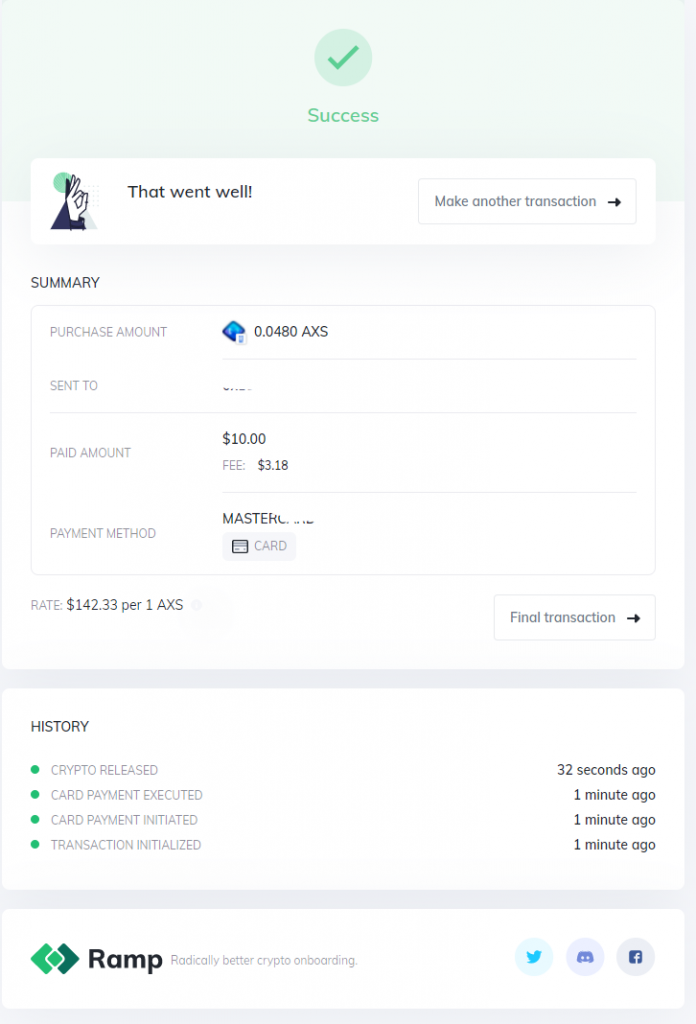

As an additional method, I had a friend try and purchase directly from the Ronin Chain, and they were succesfully able to buy $10 worth with their mastercard.

For those who may not know what staking is, staking allows you to learn interest on your crypto holdings by agreeing to commit your holdings for a certain period of time. These committed tokens contribute to the blockchain network as part of the proof-of-stake consensus mechanism. It’s essentially the new “mining”. It’s similar to how stock holders are paid dividends for holding shares, to encourage you to hold it for long periods of time.

Calculation of Returns At Current Staking Rate

With $1000 invested at a 100% APY, your initial investment should grow to $2714 in 365 days.

It is important to distinguish between capital appreciation and investment income.

The result of your final ROI depends on what price you buy AXS at and whether it appreciates or depreciates.

Let’s assume you buy 10 AXS worth $100/each totaling $1000, for simplicity sake.

Imagine $1000 invested with 0% capital appreciation and 100% interest rate for 365 days. Compounded daily that equates to 171% or $1714 in investment income. So you would end up with 27.14 AXS worth $100/each totaling $2714.

I will go more in-depth into investment scenarios after discussing staking delay below.

Why AXS Stands out as The Best Staking Investment Vs. Other Crypto Projects

There are a lot of coins you can stake, but you want to maximize returns with minimizing risks. BTC and Etherum will give you 5-10% for staking, but that’s not enough to make it worth your time. Certain projects like Slavicoin appear to offer 500% staking returns but they don’t look trustworthy. See below.

I believe AXS offers the best balance of high staking rewards (strong reward) and high market cap (lower risk). We will make the assumption that higher market cap projects are lower risk because more people have invested in and vetted the project.

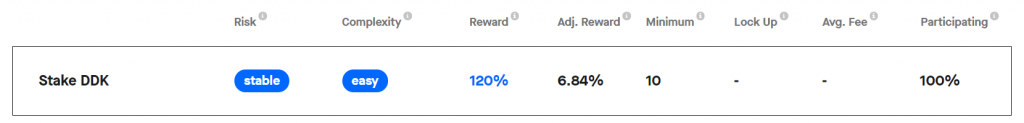

You can see DDK coin also appears to offer 120% staking APR, but when you view into the details page, it appears that the adjusted reward is only 6.84%. I think this is because there is a high amount of inflation of the coin. I don’t know if that affects profits, but I know it affects your overall share of the staking pool.

It appears that AXS will also suffer from some inflation, but not a significant amount. I don’t believe staking affects your overall ROI, it just affects your % ownership of shares. Think of it like if you own shares in a company and they print more shares. Printing more shares usually causes each share to be worth less, but it’s not a sure thing.

AXS also benefits from a highly flexible staking model – no lockup period. You can stake or unstake at any time with no fees. You can do it independently without having to join a staking pool or running a validator node.

Are we early to this investment opportunity or are we late?

To make money in investing you have to find information imbalances, and then get in early. This is when you discover something substantial that others don’t.

For AXS, we are not the “innovators” here, but more so the “early adopters”. The innovators are people who bought the coin when the project launched in 2018 or when the company had an IEO on Binance in Oct 2020

Through intense googling and searching on Reddit, there are few guides or experience posts about staking the coin. Here is one YouTube video of another guy who has the same strategy as this post. There are 12 YouTube how-to stake Axies videos as of today. But I think this blog post is probably one of the most thorough write-ups to date. I feel like AXS stakers are hesitant to “share this gem” because the more people stake, the more the APY will go down.

This staking project launched on Sept 30th, 2021. At the time of this post, that is less than 45 days ago, so safe to say not a lot of people know about this. Therefore, I think we are relatively early to the game here.

Staking Rate Decay

Summary: The staking APR until December will fluctuate between 124%-81%, then decrease by 22% on January 2021 to be in the range of 102%-59%.

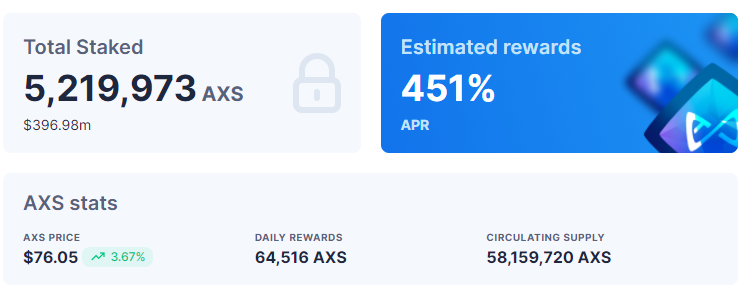

Here’s the breakdown. The more people who stake this coin, the more the % yield will go down, because it has to be shared among stakeholders. The yield began at 411% on launch day and are now down to 124% (see screenshot)

Extrapolating from above, we can calculate the staking rate:

Staking APR = Daily Rewards / Total Staked AXS * 365 days

Staking APR = 64516 / 5,219,973 AXS * 365 = 4.37 or 437% APR (~10% fluctuation)

Staking APR = 64516 / 19,015,007 AXS * 365 = 1.23 or 123% APR

So if we assume that new stakers join at the same rate as the last 30 days i.e. Total Staked AXS reaches 33 million, then the APR will decrease to 71%. It is hard to predict how many new stakers there will be because its dependent on so many factors including price movement of AXS, competing staking opportunities e.g. the new Katana liquidity pool, and more.

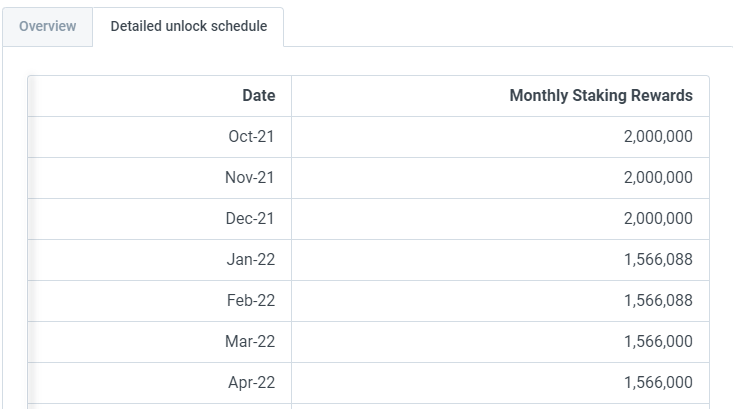

The staking APR has a scheduled decrease as follows:

First 3 months (Oct 2021 – Dec 2021) 2,000,000 AXS monthly reward i.e. 64516 AXS daily rewards

Next 3.5 years (Jan 2022 – June 2025) 1,566,000 AXS monthly reward i.e. 50516 AXS daily rewards (22% decrease)

Final 6 months (June 2025 – Dec 2025) 1,044,000 AXS monthly rewards i.e. 33677 AXS daily rewards (33% decrease)

Therefore, we can model the staking rate decrease as follows:

Staking Rewards Decay = Current Staking APR (124%) – Decrease from new stakers – Scheduled Decrease

As a ballpark estimate, let’s assume the Total Staked increases from 19million to 29million.

The formula would be: 124% – 43% – 22% scheduled decrease = 59% APR

Therefore the staking APR until December will fluctuate between 124%-81%, then decrease by 22% on January 2021 to be in the range of 102%-59%.

Investment Result Scenarios

Let’s assume you invest $1000 in AXS at $100/share and the AXS staking APR is 100%

Bullish scenario: If the asset price were to rise by 50% by the end of the 365 days, your capital appreciation would be $1357. So $1000 initial investment + $1357 in capital appreciation + $1714 in investment income = $4071. In share value that would be 27.14 AXS worth $150 totaling $4071.

Bearish scenario: If the asset price were to fall by -63% in value at the end of the 365 days, your capital appreciation would be -$700. So $1000 initial investment – $700 in capital appreciation + $1714 in investment income = ~$1000. In share value that would be 27.14 AXS worth $37 totaling $1004. You still break even.

Staking APR reduction scenario: I feel like this is a the most realistic case so I wanted to include it. Imagine the asset were to rise in price by 20% at the end of 365 days, however the staking rewards are reduced by 50% after 6 months, because a lot of other start staking as well. So for your first 182 days, your $1000 initial investment + $647 in interest income (at 100% APY) totals to $1647. For your second 6 months, your $1647 investment+ $467 in interest (at 50% APY) = $2114. $2114 + capital appreciation of 20% = $2536. So at the end your share value you would have is 21.14 AXS worth $120 totaling $2536. Still a pretty good outcome.

Worst case scenario: Imagine the asset were to fall by 90% AND the staking APR get slashed to 0%. You’d be holding 27.14 AXS shares worth nothing. It would be the equivalent of holding shares of a company going bankrupt and having its dividends getting slashed. I’ll talk more about this in the risks section at the bottom.

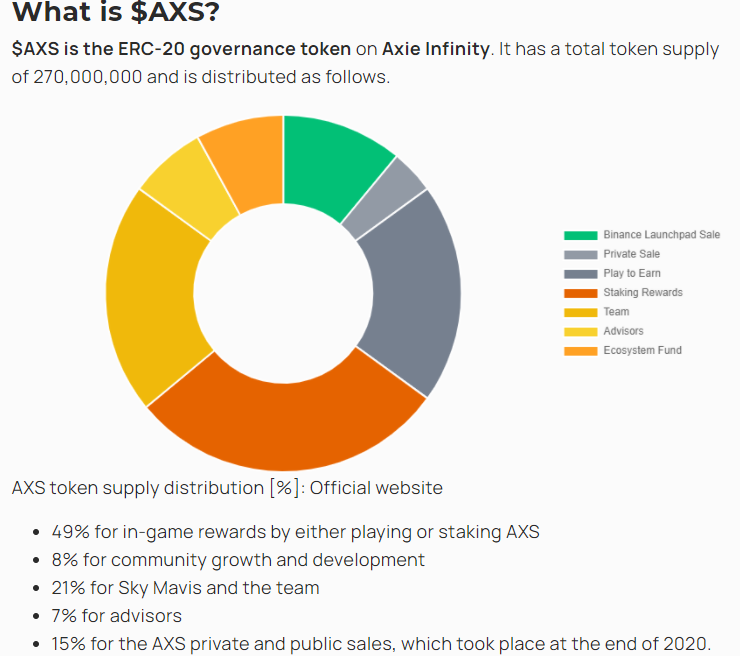

The Tokenomics of AXS and Supply Distribution

This begs the question, why

My Investment Style

I believe that great investors focus on preservation of capital with steady growth, as opposed to risking all your money with the goal of maximizing gains. Crypto is already such a chaotic industry, you have to work extra hard to protect your initial investment. I believe this investment opportunity provides a high upside (200% per year) with limited downside (even if the price goes -63%, you still break even assuming the staking rate is stable).

If you want a lower risk/reward profile you can just buy and hold ethereum and leaving it in a BlockFi account at 5% interest. But if you want as risk profile that low, you could also just buy high growth tech stocks.

If you want a higher risk/reward profile, you could invest in IEOs on Binance or Kucoin which I think is also pretty solid and fairly low risk. Or if you want to be a cowboy you could take a shotgun approach and invest $100 in 20 shitcoins and have 19 of them go bankrupt and 1 of them go 50x, which would give you a positive expected value.

Potential Risks Around AXS Staking

I thought it would be good to cover some potential scenarios.

- The company might go rogue and steal all the staked money (seems unlikely with A16z backing them, and you can follow the founder on LinkedIn),

- The project might get hacked and the funds go missing.

- The game may lose users to competitors (Starsharks is a literal copy of their game with a launch date in 30 days)

- They suddenly change the staking rates and your returns are gone – if this were to happen, I’d unstake and find another investment opportunity.

- The price of bitcoin tanks, and all cryptos crashes along with it. However this would be an overall industry risk, not an AXS risk.

- Overall, the risks are real but tolerable.

In summary, I see this as the best current crypto opportunity I have come across so far and have plans to allocate a significant amount of my portfolio to this project.

Want To Try It?

If you have any interest looking into it further, let me know and I can help you get set up. You can even stake $10 if you want to just try it, it doesn’t matter to me. My goal is to educate the people around me so they can help contribute to my hypothesis. All of the research above was done just by me. Imagine what we could do as a group.

Links:

Axie Infinity Staking Dashboard

Official Axie Infinity Staking Guidebook

https://www.stakingrewards.com/earn/axie-infinity/

https://beincrypto.com/learn/axie-infinity-axs-explained/

https://discord.com/invite/axie

Binance IEO Launch Announcement on Oct 2020

Appendix – Staking AXS vs. Farming Ronin for LP Token

In January 2022, I decided that Farming $RON has become an even better investment strategy than staking. Here’s why https://ryaning.com/blog/why-farming-ronin-token-has-a-better-roi-than-staking-axs/